Grocery Growth: UK Supermarket and Convenience Openings in 2024

2024 saw major shifts in UK grocery retail with bold expansions, innovative formats, and strategic closures shaping the industry.

2024 has been a transformative year for the UK grocery sector, marked by significant expansions across convenience stores. The supermarket retail landscape continues to evolve in response to shifting consumer preferences.

In this blog, we’ll delve into the highlights of the year, summarizing the most notable store openings, trends, and innovative strategies shaping the industry. Whether you’re tracking retail developments or simply curious about the changing face of your local high street, this summary offers an insightful overview of 2024’s most exciting grocery milestones.

In September 2023 Aldi hit the 1,000 milestone with their store opening in Woking. Since then they have opened 51 stores, a combination of new and relocations, 29 of these openings were in 2024:

-

East of England: Waltham Cross

-

East Midlands: Ellistown, Shepshed, Swadlincote

-

London: Beckton, Holloway, Leytonstone, Muswell Hill

-

North West: Ashton In Makerfield, Congleton, Preston, Skelmersdale

-

North East: -

-

South East: High Wycombe, Horsham, Olney, Queenborough, Totton

-

South West: Bristol

-

West Midlands: Mere Green, Rugeley, Sedgley

-

Yorkshire & The Humber: Goole, Middleton Leeds

-

Scotland: Castle Douglas, Dundee, Loadhead, MacDuff

-

Wales: Aberdare, Newport

Of the eight closures in 2024, seven locations still have Aldi presence in the same towns: Airdrie, Middleton Leeds, Middleton Greater Manchester, Newport, Preston, Rugeley, Selby. Aldi Sheerness closed with the opening of a store in July 2024 in the next town along, Queensbury.

Aldi has announced it plans to invest around £650 million across Britain next year. The supermarket is targeting around 30 new store openings in total in 2025, contributing to their previously stated plans to grow to 1,500 across the UK.

Aldi opened its first UK store in Stechford, Birmingham, in 1990. The 'Aldi Local' concept was first launched with a 6,500sq ft store in Balham, London in 2019. The format is smaller than a standard Aldi and typically stock a reduced product range with a focus on more grab and go items. This fascia can be found across Greater London with the most recent opening on Holloway Road, Islington on the 24th October 2024.

Amazon Fresh opened their first store one day short of a year since their last opening, West Hampstead opened on 28th November 2024. This takes the brand to 21 locations across Greater London.

Asda has 1,106 stores across the UK with their supermarkets, superstores, supercentres, express and living stores.

In 2020 Asda launched their 'On The Move' fascia to expand its presence in the convenience sector and increase the number of customers who could access their products by opening roadside and neighbourhood locations. In February 2023 they celebrated the opening of their 100th On The Move store. By late 2023 Asda began converting the 'On the Move' stores to 'Asda Express', as part of their broader initiative to accelerate growth in the convenience market.

2024 welcomed 262 Asda Express openings taking their total to 478. One supermarket opened in May 2024 at Hale Barns, Altrincham in the closed Booths store. Of the 99 closures Asda made in the year, there was one Asda Express in Feniscowles, a village west of Blackburn and ninety-eight Asda On The Move conversions or closures.

Booths is a chain of high-end supermarkets in Northern England. They have 26 stores; 15 stores in Lancashire, 7 in Cumbria, 3 in Yorkshire and 1 in Cheshire. 2015 was the biggest year for Booths when they opened five new stores: Barrowford, Burscough, Poulton, St Annes and Hale Barns, the latter closed in April 2024.

In May 2021 Booths introduced a new wine bar concept at Booths Lytham. The Gallery Wine Bar offers morning coffee and pastries, light lunches and evening drinks.

Budgens has 385 stores, 384 across Great Britain primarily in England with 4 stores in Scotland and 2 stores in Wales. Budgens has had a busy year, opening 77 stores and closing twenty-six. 2024 openings included their first store in Guernsey, in the area of Vale.

The Co-operative Group continue to open and close stores. 2024 saw forty new openings and over one hundred closures taking them to over 2,400 locations across the UK. The openings are a range of standalone, parades, universities and hospitals. Most closures are standalone sites, parades, village and urban centres, some being converted to Asda Express.

Various co-operative societies in the UK have undertaken strategic decisions regarding their store portfolios, leading to both openings and closures.

COOK offer hand-prepared, frozen meals through their stores and from over 1,000 independent stockists across Great Britain. The brand has gone from strength to strength since opening a small shop in Farnham in March 1997. COOK celebrated opening their 100th shop in Poynton in March 2024, along with 5 other openings this year:

- COOK Poynton (March 2024)

- COOK Heswall (June 2024)

- COOK St Albans (July 2024)

- COOK Chelmsford (October 2024)

- COOK Frinton on Sea (November 2024)

- COOK Christchurch (November 2024)

Costco have warehouses in fourteen countries, entering China in 2019 and New Zealand in 2022. They first opened in the UK in 1993 in West Thurrock, Essex and now have 29 stores across Great Britain. The most recent opening was in July 2019 in Stevenage. Last year articles suggested that Costco had intentions to open 14 news stores over the next two years. In December 2024 Gloucester City Council approved plans for a new Costco store with construction expected to start as soon as possible.

Dunnes Stores is an Irish multinational retail chain which has locations in Ireland, Spain and 15 stores in Northern Ireland (NI don't currently sell grocery). In 2023 they reported their best financial year in their Northern business for a decade.

The frozen food retailer Farmfoods has 351 locations across Great Britain. In spring 2024 they reported their annual turnover had passed £1bn. They have been averaging 13 openings a year for the last 5 years but in 2024 announced they are targeting 20 to 30 new stores a year with a focus on London. This year they opened fifteen locations, four of which within Greater London and closed four.

Heron Foods have 313 stores across England and Wales, 21 stores were opened in 2024, the most in a single year since 2020. The majority of their locations are in Town Centres and on Parades. The three store closures this year were all relocations to nearby units; Langrick Boston, Newton Aycliffe and St Helens.

Iceland opened 13 new stores in 2024, all but one being under The Food Warehouse fascia. A combination of new stores, relocations and fascia changes. Iceland closed 12 stores this year; eight Town Centres, one Retail Park, two standalone Shopping Centres and one Urban Centre, some being relocations. In Dagenham the supermarket relocated a few minutes walk to the former Wilko store in Heathway Shopping Centre.

Lidl has 1,010 stores across the UK, 24 openings in 2024, a similar number to 2023 but lower than in previous years. Lidl had announced plans in 2021 to reach 1,100 stores by the end of 2025, but in 2023 revealed they had scaled back plans.

While Lidl continue to open standalone locations, Retail Park locations have slowed and this year they haven't opened any new City Centre locations to join the existing seven: Belfast, Bristol, Glasgow, Liverpool, Manchester, Sheffield and Southampton. The brand opened eight new stores on two days in December 2024 including Caterham Town Centre, Forest Gate Urban Centre in East London. Northern Irelands 43rd Lidl opened in place of the derelict Carryduff Shopping Centre. 2024 regional openings:

-

East of England: Downham Market, Hemel Hempstead, Ipswich

-

East Midlands: Long Eaton

-

London: East Ham, Forest Gate, Fulham Broadway, Hoxton, Newbury Park, Wandsworth

-

North West: Altrincham

-

North East: -

-

South East: Alton, Burgess Hill, Caterham, Shinfield, Worthing

-

South West: Bovey Tracey, Bristol

-

West Midlands: Birmingham - Selly Oak

-

Yorkshire & The Humber: -

-

Northern Ireland: Belfast, Carryduff

-

Scotland: Edinburgh - Meadowbank, Edinburgh - Pilgrig

-

Wales: Connah's Quay

Makro, a Cash & Carry retailer, began its operations in the UK in 1971 and has 26 locations across the UK. In 2012 it was acquired by Booker from German based company Metro. There have been no recent new Makro store openings in the UK.

This year Marks & Spencer (M&S) has been actively expanding and refurbishing its store network. A combination of company owned and franchised stores takes their estate to 1,055.

New store openings in 2024 include Washington The Galleries (30th May), Dundee Gallagher Retail Park (16th July), Selby Three Lakes Foodhall (28th November) and Battersea Power Station (4th December). In a strategic shift, M&S opened its first clothing-only store in London's Battersea Power Station this year. The store focuses exclusively on clothing and beauty products, marking a departure from the traditional combination of food and clothing offerings.

M&S Brixton Road reopened on 20th November 2024 after a seven-month refurb.

Closures this year include Peterborough, Neath, Sunderland (May 2024), Walworth, Ilford (June 2024), Dundee (July 2024), Leicester, Redhill (August 2024) and Crawley (Nov 2024).

Morrisons are nearing 500 full range stores thanks to their opening in new town Cranbrook, Exeter on the 12th December 2024 taking them to 497.

Morrisons first trialled their convenience fascia Morrisons Daily in 2015, which was developed to tap into the growing demand for convenience shopping by providing essentials and serving local communities with accessible locations, many located at petrol stations, via smaller-format stores. The chain have expanded their Daily fascia rapidly, in part due to the acquisition of McColl's in 2022. As of September 2024 all remaining shops were converted to Morrisons Daily and in May 2024 Morrisons acquired 38 stores in the Channel Islands from long term partner SandpiperCI. With 488 openings in 2024 and 361 in 2023 this takes the fascia to 1,244 locations.

A combination of Morrisons, Morrisons Select and Morrisons Daily takes the brand to 1,745 locations. They don't plan to slow down either, aiming to open 400 more stores by 2025, which would bring their total to 2,000.

Planet Organic, probably the UK's first organic supermarket first opened in 1995 in Westbourne Grove, London. The brand has 9 stores across London with no openings or closures occurring in 2024.

Sainsbury's have had a similar number of openings in 2024 as in 2023 but fewer closures with only three, down from eleven in 2023. With twenty-one new Sainsbury's Locals and three new Sainsburys; Llantrisant, Southport & Winchburgh, this takes the retailer to 1,444 stores, 845 of which are Locals.

2024 also welcomed Sainsbury's first ever airport store, opening at Edinburgh Airport on the 12th December and is located before security. They also opened their first city centre store since 2021 with the Sainsbury's Local on Oldham Street in Manchester.

Keeping track of symbol groups can be a challenge all of its own. For those unfamiliar, a symbol group is a type of franchise where independent shops trade under a common banner, but are not owned or operated by the group. This means there can be large scale changes, 2024 alone saw 102 Spar additions and 122 Spar closures.

Seventy-two new Tesco's opened in 2024 taking the chain to over 2,900 locations across the UK under their Superstores, Extras and Express'. Of the 64 new Express stores, three of them can be found on the Isle of Man (Castletown, Peel, Ramsey). Of the eight new superstores opening this year, five opened on the Isle of Man (Douglas, Onchan, Peel, Port Erin, Ramsey) taking the Tesco island total to nine, this is due to the purchase of Shoprite which was agreed towards the end of 2023.

Tesco closed nine stores in 2024, two of those being superstores; Chippenham and High Wycombe. In August Chippenham lost its central superstore but opened a Tesco Express nearby. A similar situation occurred in High Wycombe in October but this store has only closed till next autumn while its under renovation, a temporary express store has opened in the meantime.

Waitrose opened its first store in six years, Little Waitrose Hampton Hill opened on November 28th 2024. It's great to see a new opening from the retailer after a quiet few years, and it looks set to continue. In August 2024 they announced plans to open up to 100 convenience shops in the next five years. Their partnerships with Welcome Break and Shell are sure to play a role in the Waitrose convenience growth strategy. In January 2025 Waitrose will join Pret, Starbucks, KFC and Burger King at the new Rotherham Services Welcome Break.

Whole Foods Market have five stores in London after the closures of their Fulham and Richmond stores in Spring 2024. In growth news for the brand they have signed a lease to open at One Twenty King's Road, Chelsea.

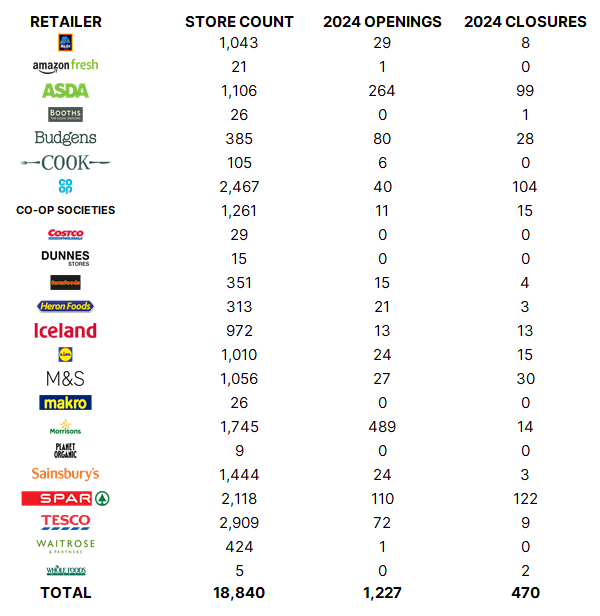

Grocery Retailer Opening and Closures in 2024

Grocery Retailer Openings by Retail Place Type

When analysing the new openings against Geolytix Retail Places, parades were the favoured location type to open on in 2024 for grocery retailers, which follows the trend of previous years. This year Town Centres have seen an increase, accounting for 17% of 2024 openings, up from 9% in 2023 and 5% in 2022. Village Centres are also experiencing an increase compared to previous years with 14% of this year openings locating here, an increase from 10% in 2023 and 8% in 2022. Retail Parks on the other hand have seen a fall in grocery openings compared to their peak in 2020 which accounted for 17% of the openings that year, slowly decreasing to 10% in 2022, 7% in 2023 and 6% in 2024. This is not surprising given the increase in motivation by many grocery retailers for a smaller convenience store offer focusing on neighbourhood and roadside locations.

Grocery Retailer Openings by Region

Lidl favoured London (25%) and the South East (21%) which accounted for nearly half of their openings in 2024. The South East region was most popular for new Aldi's too, welcoming 17% of their 2024 openings, followed by London, North West & Scotland each contributing 14% of new stores. Neither opened stores in the North East. Lidl, M&S, Spar and Tesco were the only retailers to open new stores in Northern Ireland. Asda Express and Morrisons Daily both opened or converted nearly a fifth of their new 2024 stores in the South East region.

Summary of 2024

2024 has been another interesting year for the UK grocery sector; significant store openings, strategic closures, and dynamic shifts across major supermarket chains and convenience locations. Key trends include increased investment in convenience formats, improvements to existing stores and relocations, regional expansion, and a focus on meeting evolving consumer preferences. These developments highlight a competitive market with retailers striving to adapt and innovate. 2025 looks set to be another exciting year.

Where can I access the data?

GEOLYTIX tracks 22 grocery retailers and the above analyses those brands. In October 2024 we celebrated 10 years of releasing this open data set, we are extremely proud to release our Grocery Retail Points quarterly. You can view and download the data here. We would love to hear how you use this completely free and open to use data, please tag us on LinkedIn @Geolytix or email us at info@geolytix.com.

Louise Cross, Product Owner at GEOLYTIX

Numbers reported are based on Geolytix data, research and openly available information.

Photo by Scott Warman on Unsplash