Office Place Recovery

Through the last 15 months, we have been using mobility data and applying it within 8,000 of our Retail Place boundaries to produce a weekly read on activity levels across the UK.

With a steady uptick since the lifting of restrictions in April, our headline recovery rate approached 90% last week, with over three quarters of places in most Retail Place Types (e.g City Centres, Town Centres, Village Centres, Parades) now recording Medium, High, or Very High levels of recovery.

However, with Retail Recovery continuing apace across most places, our focus has been drawn into those locations that remain significantly impacted. Retail Places in Airports and Rail stations are obviously seeing much lower levels of recovery. But otherwise, the main places that stand out are the Office Worker locations – with the big outstanding, long-term-implication question being the extent to which Office activity returns to ‘normal’. This clearly has huge relevance for retailers, F&B operators, landlords, office owners and occupiers. The answer to the question will fundamentally shape how these important and valuable places evolve and develop.

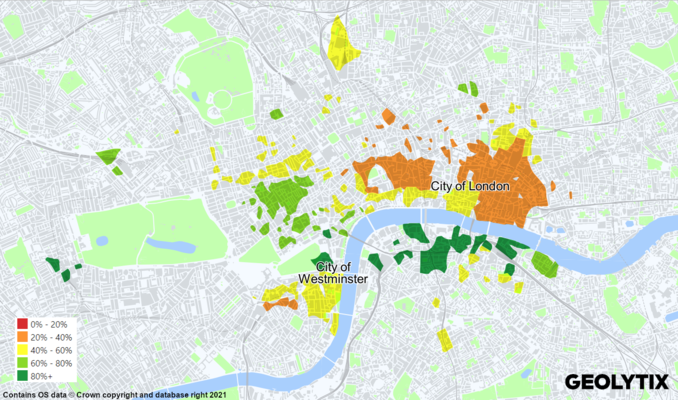

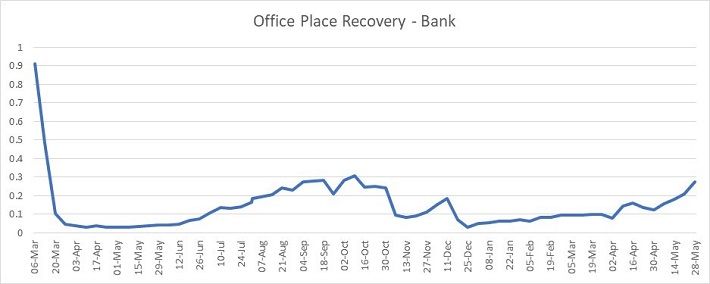

To get as best a view on what is happening as possible, Geolytix have built out a new data product – Office Places. This has been built by identifying the Workplace Zones with the highest volume and density of people engaged in the type of work that has (historically at least) been performed in Offices. We have then joined these Workplace Zones where they are neighbouring and aggregated them to construct Office Place boundaries. We have then taken the top 110, which all have at least 3,000 Office Worker, and in the same way that we’ve done for Retail Places, we have then applied the mobility data to these boundaries. As expected, we can see the overall activity levels vs pre-Covid baseline in the Office Places is significantly lagging Retail Places.

Mapping these, there is interesting variation, with type of Office Work being an obvious differentiator (Banking / Financial Services activity levels in the City very low). The size of organisations, the nature of the buildings and their suitability for socially distanced, covid-safe return of work, and the ability for work to be undertaken away from the office are all factors that will influence the pace and extent of Office Place recovery.

Whilst lots of people have lots of different opinions on what the future of offices will look like, for organisations with presence in these locations, up-to-date data to help understand what is ACTUALLY happening and how things are shaping up will be invaluable as decisions are made on what the optimal use of space in these places looks like in the future.

To find out more, please contact Ben or Tim at Geolytix (ben.purple@geolyix.com, tim.pickworth@geolytix.com)

Title Photo by Israel Andrade on Unsplash