Danish Design and Hygge Homeware - variety store trends in the UK

Josh reviews the grand opening of Søstrene Grene in Leeds along with other Danish brands taking the UK by storm. Who could be next?

This January we attended the grand opening of the latest UK branch of Danish variety retailer Søstrene Grene, at the Trinity shopping centre in Leeds. From our privileged position at #2 and #3 in the queue, we were treated to a tote bag of goodies, as well as a two-woman ballet performance set to a live string duet. At 10am on the dot we were led into the winding maze of homeware - organised not by room or theme, instead by hue - whereupon I quickly bought too many candles and a vase.

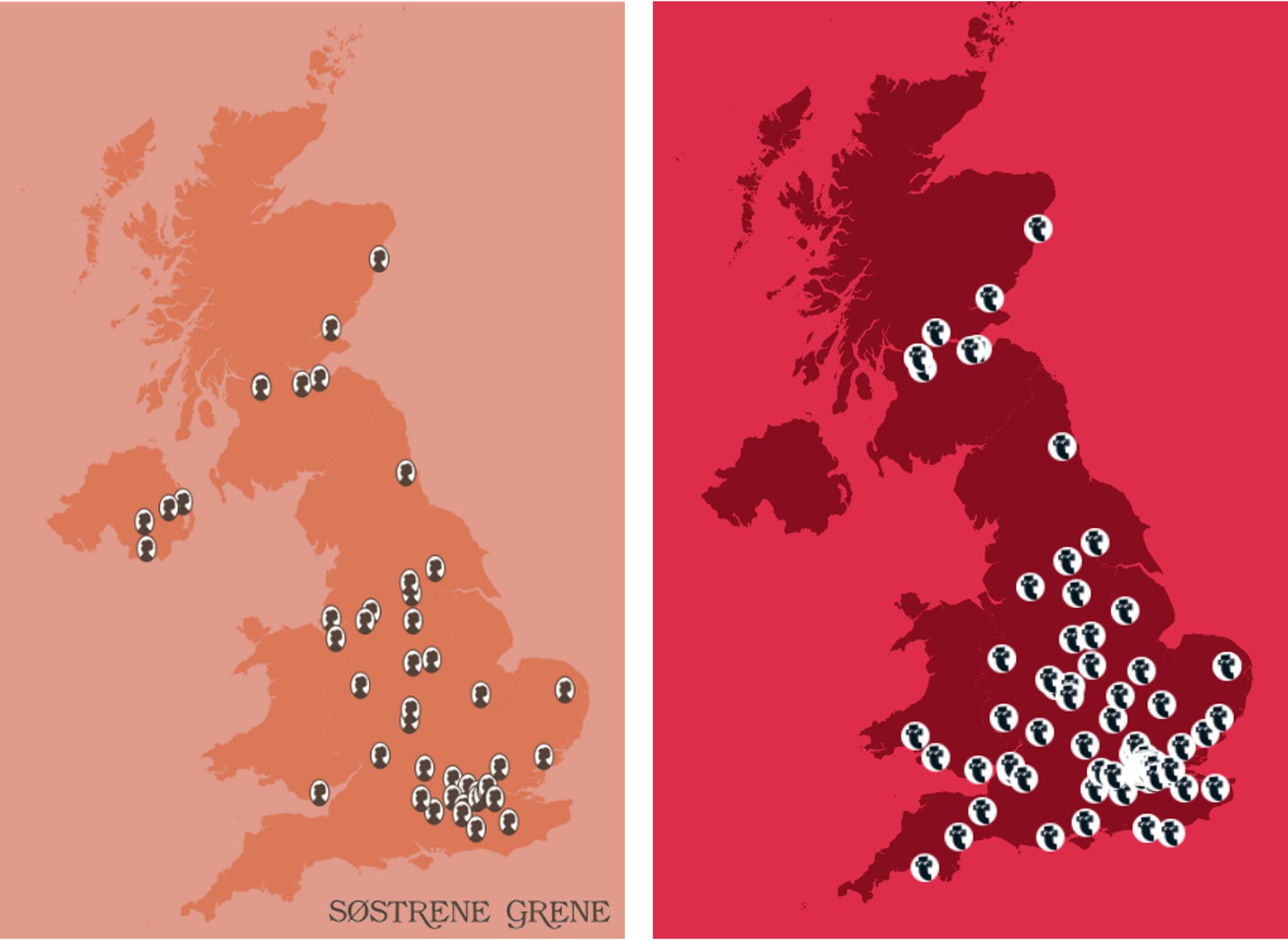

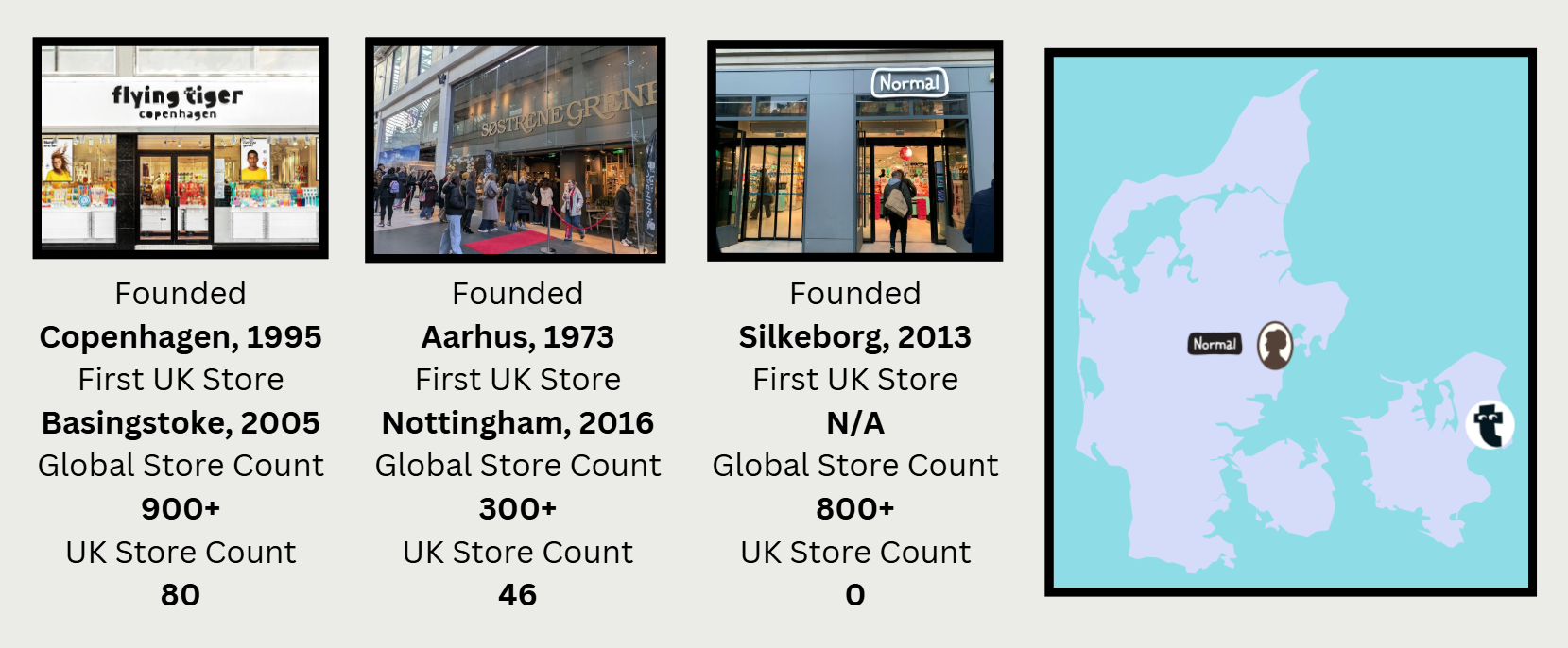

This was Søstrene Grene's first UK opening of 2025, which held an energy and an eagerness that belied the stormy weather. They've been growing fast in the last 6 months, not just in the UK where they now have 46 locations, aiming for 100 by 2027, but also in Europe where there are over 250 more. They're not the first Danish variety store to take the UK by storm in recent years, but their aesthetic is notably different from Flying Tiger, who despite also offering some homeware items, mainly stock toys and accessories. What is it then about Danish variety that is so attractive to the British high street shopper, allowing them to compete with home-grown chains like B&M and Poundland?

A feature of both Søstrene Grene and Flying Tiger, as well as another Danish variety store Normal that's yet to cross the Nordsøen, is the IKEA-style winding path layout, meaning you cannot see the whole of even a small store from the entrance. Combining this with the "treasure hunt" style shelving system (to quote Flying Tiger's former CEO Mette Maix), means that even with a specific shopping mission in mind, a customer must travel through the entire store, looking at every shelf with equal focus - meaning that they may end up with more in their basket than they expected by the tills.

Søstrene Grene locations also hold a sense of exclusivity, with their products being primarily own-brand, injecting a feeling of luxury despite the lower price points. There's a lot of wood, ceramic and paper, with minimal single use plastics, both in the product lines and the décor. Many of the stores are being placed directly next to high end brands - the Oxford location which opened in the Westgate Shopping Centre this past August (2024) occupies the old Ted Baker unit, and is adjacent to the likes of Charles Tyrwhitt and Flannels.

Could it be then that, with rising cost of living, shoppers want a bit of the indulgence that's normally associated with eclectic antiques shops or cosy handmade homeware, without the high prices those things usually demand?

Denmark's aren't the only variety shops to make their way onto British high streets of late. With over 7,000 locations worldwide, Chinese giant MINISO opened its first UK store in 2019, quickly reaching 35 sites by time of posting. We’ve got one in Leeds now too! Despite a later start than Flying Tiger, Søstrene Grene, or even Japanese retailer Muji who have been around in the UK since 1991, MINISO seems to be slotting neatly into all of the same city centre locations, and rapidly acquiring the rights to dozens of product IPs - thereby also directly competing with the gift & souvenir market.

So it seems like this shift in UK variety retail has been building up for a decade or longer, and is now locked in post-Covid. Consumers are spending more time working from home, and want an affordable, hygge homelife surrounding them.

Geolytix Retail Universe is a comprehensive data set of over 100,000

store locations covering more than 500 major brands across the UK.

• Find your competition and spot opportunities, or avoid saturated areas

• Locate benchmark brands to take advantage of existing footfall

• Optimally locate your asset for potential customers

• Understand the retail provision

• Review locations to quickly identify potential or discount as an option

• Monitor trends of sectors growing or declining

Get in contact if you would like to know more about this data set.

Josh Reynolds, Data Scientist at GEOLYTIX

Images: Authors own